Friedrich is the name given to our algorithm for analyzing companies that trade on the global stock markets. In creating Friedrich we concentrated on analyzing each company’s Main Street operations through various established ratios, along with our own unique ratios that we developed over the last 30 years. What we came up with is a final "Main Street" price per share based on Generally Accepted Accounting Principles (GAAP), which is a framework of accounting standards, rules and procedures defined by the professional accounting industry, which has been adopted by nearly all publicly traded U.S. companies. We feel that our Main Street price result is what each company would need to trade at in order to be attractive to a businessperson on Main Street looking to buy at a bargain.

Since the only constant in the universe is change, the results for each company fluctuate by varying degrees. No company is an island unto itself, but each operates in a world of constant change and at times in areas where Chaos is the norm. By analyzing a company’s Main Street operations over time, Friedrich is able to give the potential investor a decade long analysis (opinion) as well as offering a Trailing Twelve Month (TTM) analysis (opinion), as well. Thus our readers will not only get as close to a real time view of operations on Main Street as is possible, but then can measure the consistency of the company’s operations over time to determine if she should invest or not.

Through our Friedrich algorithm we can analyze ten years of Balance Sheet, Income Statement and Cash Flow Statement data for each company all at once and generate one final result in seconds. Friedrich was designed to be ultra-conservative and thus will cut zero slack to any company under analysis and will do so with zero emotion. Companies must be exceptional in order to get an attractive Main Street valuation and the ideal investments according to our backtesting are the ones that have been consistent over time.

By being so ultra conservative Friedrich is designed to identify bargains that Wall Street investors may have overlooked. Companies shares may trade on the stock market but the companies themselves operate on Main Street, so Friedrich is designed to generate a Main Street price per share first and only then does he go to Wall Street and see the price for which Benjamin Graham’s “Mr. Market” is offering the shares.

Here is an example of a company that is booming on Main Street and according to Friedrich (opinion) is selling at a considerable discount to its Main Street Price.

As an Analyst I have developed 30+ original ratios over the last thirty years and the table above houses them all in one place for the first time ever. I store similar tables for 6000+ companies on my Google Drive Database, to which I give clients access when they sign up for my service.

All my ratios work together and through 2500 calculations form one final result called the “MAIN STREET PRICE”. From there we generate a BUY PRICE, a SELL PRICE and a SHORT PRICE to meet whatever needs our Clients may have. Obviously I cannot disclose the exact details of how each ratio above is calculated, as it is all proprietary, but what I can do is explain what to look for from each ratio in order to get the maximum benefit from FRIEDRICH.

BUY PRICE = very simply it is what we consider to be a bargain price as it is 33% below our MAIN STREET PRICE.

SELL PRICE = very simply it is 66% above our MAIN STREET PRICE.

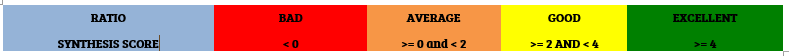

SYNTHESIS = where a perfect score is 5 and where 0 is bad. A SYNTHESIS by definition is the combination of ideas used to form a theory or system and Friedrich generates this result by combining balance sheet, income statement and cash flow statement data through some 2500 calculations that were conceived over multiple decades of testing. Thus when the SYNTHESIS result is 4 or 5, it signifies that the company is doing very well on Main Street and management is usually top notch, while 0 to 2 means poor performance.

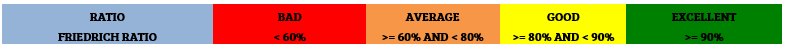

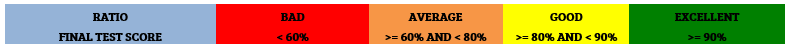

FRIEDRICH RATIO = is very similar to our SYNTHESIS equation but concentrates all its attention on Free Cash Flow and through our various original ratios scores a company similar to how school teachers grade exams. Thus a 100% FRIEDRICH score gives us a top score or A+, while anything lower than 60% gives us an F score.

RELATIVE RISK = Combines the data found in the SYNTHESIS and FRIEDRICH ratio’s and generates a result where zero is the best and anything over 50% is subpar. RELATIVE RISK is how Friedrich analyzes the risk taken to generate a certain reward. RELATIVE RISK essentially tells us how safe a company’s operations are in the current environment on Main Street vs. its Wall Street valuation.

REVENUE GROWTH = Friedrich uses revenue growth as its growth rate in all present and future value analysis that he does. He does so because unlike other growth rates, Revenue cannot be as easily manipulated by management. If management sells its company’s products at cost then it will be fully reflected in lower earnings, which management will never do as Wall Street Analysts are mainly only interested in earnings growth. A REVENUE GROWTH in the upper single digits or greater is best and one should always watch out for one-time events such as mergers and acquisitions that skew results.

BENEISH SCORE = is how Friedrich identifies manipulators in the boardroom. Companies that have positive results or scores of greater than -2.22 are considered potential manipulators. Here is a wonderful link that explains the inner workings of how the BENEISH SCORE is calculated.

And here is Dr. Messod Beneish explaining it.

FROIC = Free Cash Flow Return on Invested Capital

Uses my Mycroft Free Cash Flow (MFCF) that I introduced in my book that you can find here.

Then it divides that result into a company’s Total Capital (Total Long Term Debt + Shareholders Equity) and derives how much Mycroft Free Cash Flow is generated annually for every $1 the company invests in Total Capital to grow the business. A result of 20%+ is ideal as that means that the company is generating 20 cents in MFCF for every $1 of invested capital it employs. Accenture for example has a FROIC of 58% so it generates 58 cents in MFCF for every $1 employed.

CAPFLOW = Capital Expenditures/Cash Flow

Is a Management Effectiveness ratio that tells us how much cash flow is spent by management, in the form of capital expenditures, in order to run its company. A result of 33% or less is ideal and means that management has a great deal of money left over to buy back shares, invest in other firms and grow the company. Accenture has a result of 9%, so it only uses 9% of its cash flow to run its operations leaving 91% left over for acquisitions and share buybacks.

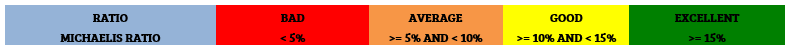

MICHAELIS RATIO = In 1989 I was four years into working on building what would later be called Friedrich and back then I read a book called "The New Money Masters," by John Train, which changed my life. In that book, one of the chapters was about the portfolio manager of Source Capital = Mr. George Michaelis, whom I consider one of the greatest investors in history. In the Appendix of that book, is part of the Source Capital annual report to investors for December 31, 1985. Here is what George wrote then.

The ratio that you see in the first paragraph is actually one of the foundational stones of Friedrich and plays a major part in my creation of the final algorithm. The reason that ratio is so powerful is because it allows one to determine a company's actual rate of growth on Main Street by incorporating its return on equity along with the company's dividend payout policy, which both speak volumes about how well managed a company is. What I look for in using what I call the "Michaelis Ratio" is a return of at least 15% or higher.

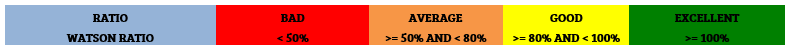

WATSON RATIO = The Watson Ratio is one of 30 original abstract ratios that I have created which, along with many others, make up Friedrich. This particular ratio deals with the relationship between a company's free cash flow and its diluted earnings per share. It uses the free cash flow methodology that Arnold Bernhard (the founder of Value Line) created, which is basically cash flow - capital spending; and divides that result by the company's diluted earnings per share. In theory, most companies should have (what I call a Bernhard Equalizer) a free cash flow result equal to its diluted earnings per share, so an average result should be 50 to 80%. When a company is well managed you will see a result greater than 100%.

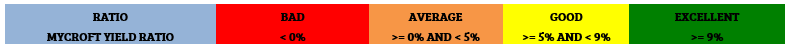

MYCROFT YIELD = Many of my clients have a great interest in Dividend paying stocks, but dividends paid on stocks are unfortunately useless to the investor in my opinion. The reason I say this is because on the day a company pays out a dividend, its stock price may be reduced by the amount of the dividend paid. So when a stock sells for $20 on the stock market and pays out a $1 dividend, on the day the stock goes ex-dividend its stock price may get reduced by $1 and become $19. I believe it is better for a company NOT to pay a dividend as that dividend is paid out of the cash from the company's cash account. The company can no longer use that money to grow on Main Street and thus hurts its growth prospects.

So when you are paid a dividend, always remember that it comes out of your stock price and thus you are simply taking $1 out of your right pocket and putting it in your left pocket, but if you are not in a retirement account you are taxed at a rate of 15% on that $1, so you only get to keep 85 cents, though your stock price is reduced by $1. The government does nothing about this because it makes a ton of money in tax revenues, from the taxes that dividend investors pay. If you want real value instead concentrate on the Mycroft Yield.

The Mycroft Yield = Mycroft Free Cash Flow Per Share/ Sherlock Debt Divisor

Mycroft Yields of +5% and above are good and those, which are +10% and above can be classified as true bargains.

PSARAS RATIO = (Sherlock Debt Divisor/Diluted Earnings Per Share) /Return on Equity)

What the Psaras Ratio tells is how the company's stock price divided by its diluted earnings per share relates to its Return on Equity. Anything below 90% is good and the lower the better.

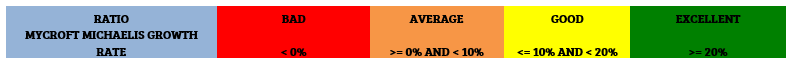

MM GROWTH RATE = This ratio determines the real growth rate of the company based on its free cash flow. It is calculated so:

Mycroft Michaelis Growth Rate = (Dividend Yield) + (FROIC X Reinvestment Rate)

Reinvestment rate = 100% - Payout Ratio

Anything above 10% is good

SHERLOCK DEBT DIVISOR = A major concern that I have these days in analyzing companies is the amount of debt each company takes on relative to its operations and whether management is abusing our current Fed inspired low interest rate policy. Debt as anyone knows, when used wisely, allows for what is called leverage and leverage can be extremely beneficial within certain parameters. On the other side of the coin, the use of debt can also be excessive and put a company's future in jeopardy. So what I have done to determine if a company's debt policy is beneficial or abusive is create the Sherlock Debt Divisor, which allows us to investigate debt in a different, more abstract way. What the Divisor does is punish companies that use debt unwisely and rewards those who successfully use debt as leverage. How do I do this? Well, I take a company's working capital and subtract its long-term debt. If a company has a lot more working capital than long-term debt, I reward it and punish others whose long term debt exceeds its working capital. So, if this result is higher than the current stock price then leverage is being used and when factored into other ratios FRIEDRICH determines if the company has properly used leverage or not. We look for stocks where the Sherlock Debt Divisor price is less than the Wall Street Price.

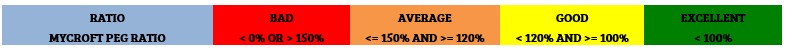

MYCROFT PEG = PRICE TO MYCROFT FREE CASH FLOW / FROIC

MYCROFT PEG = PRICE TO MYCROFT FREE CASH FLOW / FROIC

A score of 100% or below is excellent and anything over 100% or even worse a negative result needs to be avoided. What this ratio does is compare the Wall Street price of a company to its Mycroft Free Cash Flow (my own unique way of determining free cash flow) and then divides that number by the company’s FROIC. The Mycroft PEG is an abstract ratio that:

1) Separates the elite companies from the average ones.

2) Allows us to see that even though some stocks may seem overpriced or expensive, they are not because they are tearing up Main Street by outperforming.

3) Also allows us to instantly see how powerful management is as it is a management effectiveness ratio.

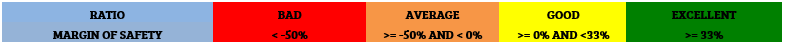

MARGIN OF SAFETY = This difference between a company’s Wall Street price and its Main Street price is called the “MARGIN OF SAFETY”. What we look for in an investment is a MARGIN OF SAFETY of +33% or higher as that would give us a nice cushion. For example, in paraphrasing Warren Buffett, you don’t want to drive your 9,999 pound truck over a bridge that has a maximum load capacity of 10,000 pounds, but it would be better to go down the road and look for one that can hold 20,000 pounds instead. That way the odds are much greater that you will be successful in your journey. Investing successfully in the stock market is no different and those who invest without a MARGIN OF SAFETY in place take on much more risk than they should.

MARGIN OF SAFETY = 100%- (PRICE/MAIN STREET PRICE)

Just because your MARGIN OF SAFETY result might be negative does mean you should run out and sell a stock, but if it were to approach a result of -100% it means that you’re holding is selling on the stock market for twice its MAIN STREET PRICE. Therefore your risk is greatly increased relative to the amount of reward you can expect based on the opinion of Friedrich.

BUFFETT GRADE = The Buffett Grade simply takes each ratio and grades each company based on how it performs per the ratios. Apple, in the example above, scored perfectly on every ratio and thus gets a perfect score of 100%. Think of this grading system just as you would in school. A+ = 100% and 60% is an F.

MYCROFT FREE CASH FLOW PER SHARE = An amplified version of free cash flow that is calculated like this = (free cash flow/diluted shares outstanding) x (100% + Mycroft Michaelis growth rate). This ratio is then used to calculate the next ratio along with others.

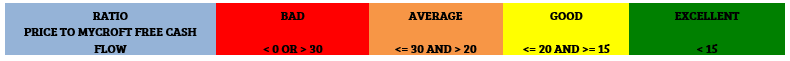

PRICE TO MYCROFT FREE CASH FLOW = Sherlock Debt Divisor/Mycroft Free Cash Flow Per Share. Under 15 is good, over 30 is bad.

PRICE TO BERNHARD/BUFFETT FREE CASH FLOW = Sherlock Debt Divisor/Bernhard Free Cash Flow Per Share. Under 15 is good, over 30 is bad. The back test generated some powerful results.

Free Cash Flow = Cash Flow Per Share – Capital Spending Per Share; and that calculation is what I used to do my Backtest of the Dow Jones Industrial Average from 1950-2009. You can read it by going here = http://nebula.wsimg.com/5b8486a6563a9f0034f637bed72aa140?AccessKeyId=F562CEE6758DD93E98E5&disposition=0&alloworigin=1

PRICE TO BERNHARD/BUFFETT FREE CASH FLOW = Sherlock Debt Divisor/Bernhard Free Cash Flow Per Share. Under 15 is good, over 30 is bad. The backtest generated some powerful results.

LORI TURBO = Mycroft Free Cash Flow Per Share – Bernhard Free Cash Flow Per Share. A positive result is what you want and a negative one means that the company is not growing on Main Street.

RIGHT TIME RATIO = Analyzes a company’s leverage management and the effects on its free cash flow growth and generation. A score of less than 1.0 is ideal while anything above 1.0 is bad.

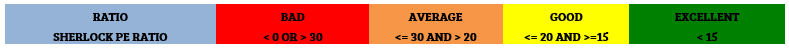

SHERLOCK PRICE TO EARNINGS RATIO (PE) = Incorporates Debt and Revenue Growth into the standard PE Ratio.

Sherlock Debt Divisor/ (Diluted Earnings Per Share * (1 + Revenue Growth)

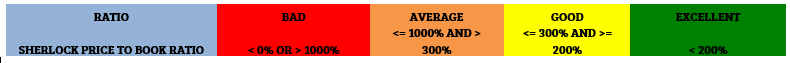

SHERLOCK PRICE TO BOOK VALUE (PBV) = Used in Michaelis Ratio

Calculation: Sherlock Debt Divisor/ Book Value Per Diluted Share

MUNGER RATIO = Named after Charlie Munger. Another Management effectiveness ratio testing how leverage is being managed through return on invested capital. A Score of less than 1.0 is ideal and over 1.0 is bad.

MARIO RATIO = Named after Mario Gabelli and relates Return on Capital to Cash Flow. A score greater than 1.0 is ideal and less than 1.0 is bad.

WILLIAMS RATIO = Named after John Burr Williams, the inventor of the two stage dividend discount model. This ratio compares the Wall Street Price to the Present Value Residual from the two stage dividend discount model using revenue growth as the growth rate, replacing owner earnings. Two results possible: 100% = Good and 0% is Bad.

BADWILL = Is a way in which Friedrich catches manipulators. When companies do a lot of Mergers and Acquisitions they tend to book a lot of Goodwill. BADWILL = (Goodwill + Intangible Assets)/ Diluted Shares Outstanding. When the Badwill to Price is 33% or greater than the stocks market price then that is a bad thing.

FRIEDRICH CASH MACHINE =( (MYCROFT MICHAELIS FREE CASH FLOW + BERNHARD FREE CASH FLOW)/2)/REVENUE) . Tells us how much Free Cash flow is generated for every dollar of revenue. A company that generates 15% or more for this ratio is a CASH MACHINE.

FRIEDRICH EQUALIZER = FRIEDRICH CASH MACHINE + REVENUE GROWTH RATE . If the result is greater than or equal to the result for the FRIEDRICH CASH MACHINE then that is a good thing. Two years in a row where the result is below signals an automatic sell. Here is a perfect example of company with great numbers, but is actually a sell as its FRIEDRICH EQUALIZER is lower than its FRIEDRICH CASH MACHINE for two years in a row. In IBM's case it is even worse (4 years) and you would have gotten an automatic sell signal in 2013 @ $177.04 despite the strong fundamentals. This is because you never want to own anything with declining revenues.

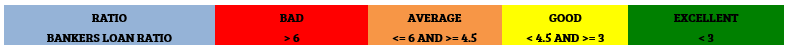

BANKERS LOAN RATIO = This ratio uses my unique proprietary methods of determining a company's debt and then divides that number by the EBITDA (Earnings Before Interest Taxes Depreciation and Amortization). What this ratio allows us to see is whether the company has too much debt on the books relative to its operations. I call it the BANKERS LOAN RATIO because a very similar formula is used by bankers and credit agencies to determine whether your credit is good enough to get a loan. The Ideal is any result of less than 3.0. Average is 3.01 to 5.99 and terrible is anything over 6 or anything with a negative result.

FINAL TEST SCORE = simply takes all ratios and combines to generate a final score similar to the grading system one would use in school. A+ = 100% and less than 60% is an F.

SUPER SIX SCORE = This ratio combines our Six most powerful ratios into one result where 6= Best and 0=Worst.

For a stock to become a buy for us it must score a 6 following these rules.

FRIEDRICH SUPER SIX CRITERIA FOR PURCHASE

1) SELL BELOW ITS BARGAIN PRICE

2) FROIC RATIO GREATER THAN 20%

3) CAPFLOW LESS THAN 33%

4) BADWILL TO PRICE LESS THAN 33%

5) FRIEDRICH CASH MACHINE GREATER THAN 20%

6) FRIEDRICH EQUALIZER GREATER THAN OR EQUAL TO THE FRIEDRICH CASH MACHINE

FRIEDRICH CRITERIA FOR AUTOMATIC SELL

1) STOCK HITS ITS FRIEDRICH SELL PRICE

2) BADWILL TO PRICE BECOMES MORE THAN 33%

3) TWO SUCCESSIVE YEARS WHERE THE FRIEDRICH EQUALIZER IS LESS THAN THE FRIEDRICH CASH MACHINE

ALTMAN Z SCORES = The Z-score formula for predicting bankruptcy was published in 1968 by Edward I. Altman, who was, at the time, an Assistant Professor of Finance at New York University. The formula may be used to predict the probability that a firm will go into bankruptcy within two years. Z-scores are used to predict corporate defaults and an easy-to-calculate control measure for the financial distress status of companies in academic studies. The Z-score uses multiple corporate income and balance sheet values to measure the financial health of a company.

Piotroski F Score

The Piotroski score is a discrete score between 0-9 which reflects nine criteria used to determine the strength of a firm's financial position. The Piotroski score is used to determine the best value stocks, nine being the best. The score was named after Chicago Accounting Professor, Joseph Piotroski who devised the scale according to specific criteria found in the financial statements. For every criteria (below) that is met the company is given one point, if it is not met, then no points are awarded. The points are then added up to determine the best value stocks.

Profitability

Positive return on assets in the current year (1 point).

Positive operating cash flow in the current year (1 point).

Higher return on assets (ROA) in the current period compared to the ROA in the previous year (1 point).

Cash flow from operations are greater than ROA (1 point)

Leverage, Liquidity and Source of Funds

Lower ratio of long term debt in the current period compared to value in the previous year (1 point).

Higher current ratio this year compared to the previous year (1 point).

No new shares were issued in the last year (1 point).

Operating Efficiency

A higher gross margin compared to the previous year (1 point).

A higher asset turnover ratio compared to the previous year (1 point).

BREAKING DOWN 'Piotroski Score'

If a company has a score of 8 or 9 it is considered strong. If the score adds up to between 0-2 points, the stock is considered weak. Piotroski's April 2000 paper Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers, demonstrated that the Piotroski score method would have seen a 23% annual return between 1976 and 1996 if the expected winners were bought and expected losers shorted. With any investment system, looking at past results doesn't always means it will work in the future, but having an investment plan and rules is never a bad idea.

SUPER THREE CRITERIA is where we store the WARNINGS.

WARNINGS occur when the stock has one of the following three happen:

1) Hits it sell price

2) Has negative revenue growth 2 years in a row (IBM for example)

3) Or Badwill to Price is 33% or greater. Badwill = Goodwill + Intangible Assets.

Thus, we have solved some of the most difficult questions to answer in Investing which are: when to buy and when to sell with the greatest amount of confidence. We now have 67 proprietary ratios working for us from different angles of a financial statement, know what a company would be worth to a private buyer (Main Street Price), know when we are picking up a bargain and know when it is time to sell.

Friedrich not only gives us a TTM view, but also allows us to view the last ten years of results in order to determine how consistent each company’s operations are on Main Street relative to its valuation on Wall Street.

I hope you enjoy our blog and will tell your friends and family about Friedrich.

For those interested in becoming a Subscriber, this is what you will receive when you sign up.

~ Complete access to our Friedrich Research Database, which is very easy to access through your desktop, tablet or smartphone, as the database is housed on our Google Cloud Drive. By simply installing the Google Drive App on your Apple or Windows based device you can have access to our charts 24/7by just typing in a ticker in the search box on your Google Drive.

~ Our Friedrich Database is constantly being updated daily and new tables are added or updated continuously. As a Client you can request that a specific Friedrich chart be created and added to our Friedrich Database whenever you want as we welcome such requests.

~ So whether you are an individual, advisory firm or an institution looking for proprietary investment research at a very attractive price, please click on the tab on the top of this page and you will be directed to our Seeking Alpha Market Place offering.

DISCLAIMER: The Fine Print: Past performance cannot be used as an indicator to determine future results. Strategies mentioned may not be suitable for everyone. We do not know your personal financial situation, so the information contained in this communiqué represents the opinions of Peter George Psaras and his Algorithm Friedrich, and should not be construed as personalized investment advice. Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for you.

Edited by Mr. Paul Ringsmuth